inheritance tax malaysia

Inheritance estate and gift taxes. It may also not push property ownership up.

New Taxes That May Be Introduced In Malaysia Mypf My

Variation of orders 039efm Page 3 Monday March 27 2006 326 PM.

. There are no net wealthworth taxes in Malaysia. The house was registered under both my parents name. Resident status is determined by reference to the number of days an individual is present in Malaysia.

Market value of the asset as at the date of transfer less the sum referred to under Paragraph 4 1 a 4 1 b or 4 1 c Schedule 2 RPGTA. This is a complicated matter when it comes to inheritance and inheritance laws in Malaysia. Inheritance tax hits the super-rich not the ordinary citizens.

The rate of both sales tax and service tax is 6. According to Khazanah Nasional Bhds book The State of Households. However it was abolished 1991.

At the time assets of a deceased individual valued beyond RM2 mil was subject to an estate tax between 05 and 10. Elaborating on capital gains tax Koong said the new proposed tax system would spook. Whether that it in equal share have to check the Distribution Act in details.

Lifestyle expenses internet newspapers books smartphones tabletscomputers sports equipment gymnasium fee and electronic newspapers maximum 2500. That means income inequality may not be guaranteed. Otherwise the Gini coefficient ratio should be consistent among countries with inheritance tax.

Generally an individual who is in Malaysia for a period or periods amounting to 182 days or more in a calendar year will be regarded as a tax resident. This is because they do not have to pay a single sen in inheritance tax unless they happen to have assets worth millions. Acquisition date and acquisition price by executor of a deceased estate.

Short title and application 2. Sometimes you have divorced parents or a deceased parent who has biological kids. If that is the case Mei Lis applicable RPGT rate shall be 20 instead of 30.

As such Mei Li is able to save RM 3650 in RPGT payments and thus will net in RM 339200 from the sale of her inherited property. RIGHT OF INHERITANCE DISTRIBUTION. However this legislation was repealed in 1991.

Chief Information Officer GCIO. My late father lived in the house with his second wife my stepmother. These biological kids may or may not have a share in inheritance when it comes to those kinds of things.

Children are entitled to the whole share if your mum pass away leaving only the three of you. Though inheritance tax may be good for the Malaysian economy and government revenue it may not be 100 effective. These tax savings are made available to Mei Li if she chooses to delay the signing of the SPA by just 1 month.

Inheritance tax will be imposed on the propertys current market value. For example the father has. An inheritance tax was implemented in Malaysia under the Estate Duty Enactment 1941.

CAP has asserted before that the average Malaysian shouldnt fear the inheritance tax. In addition the Gini coefficient ratio of Malaysia at 0407 is almost the same as the United States which has a ratio of 0390. There is currently no tax for property inheritance in Malaysia.

Time within which application must be made 5. The date of acquisition of the asset by the executor is deemed to be as at the date of death of the deceased. Malaysia used to have the Estate Duty Enactment 1941 which served like the inheritance tax.

2 ACCESS PAGE Calendar. Power of court to order payment out of net estate 4. Inheritance tax is imposing double taxation and punishing years of hard work Parents make many sacrifices for their children to have surplus savings from their income after paying taxes and other living expenses in order to invest in assets including properties that can yield returns in the future and these assets are often accumulated.

LAWS OF MALAYSIA Act 39 INHERITANCE FAMILY PROVISION ARRANGEMENT OF SECTIONS ACT 1971 Section 1. Effect and form of the order 6. Study fees for acquiring post graduate study at recognised institutions or professional bodies in Malaysia for the purpose of acquiring any skill or qualification - maximum 7000.

There are no inheritance estate or gift taxes in Malaysia. It all depends on the scenario. This would imply that inheritance tax does not play a key role in reducing income inequality.

An estate of a deceased was liable to a five per cent tax if it was valued above RM2 million and 10 per cent if it was above RM4 million. Under the Distribution Act should your mum pass away leaving three children and your dad and no parents your dad is entitled to 13 of the share and the three children 23. Property tax is levied on the gross annual value of property as determined by the local state authorities.

Investors Must Beware Of High Korean Inheritance Tax Asia Times

Inheritance Tax Is Causing A Stir Dot Property Malaysia

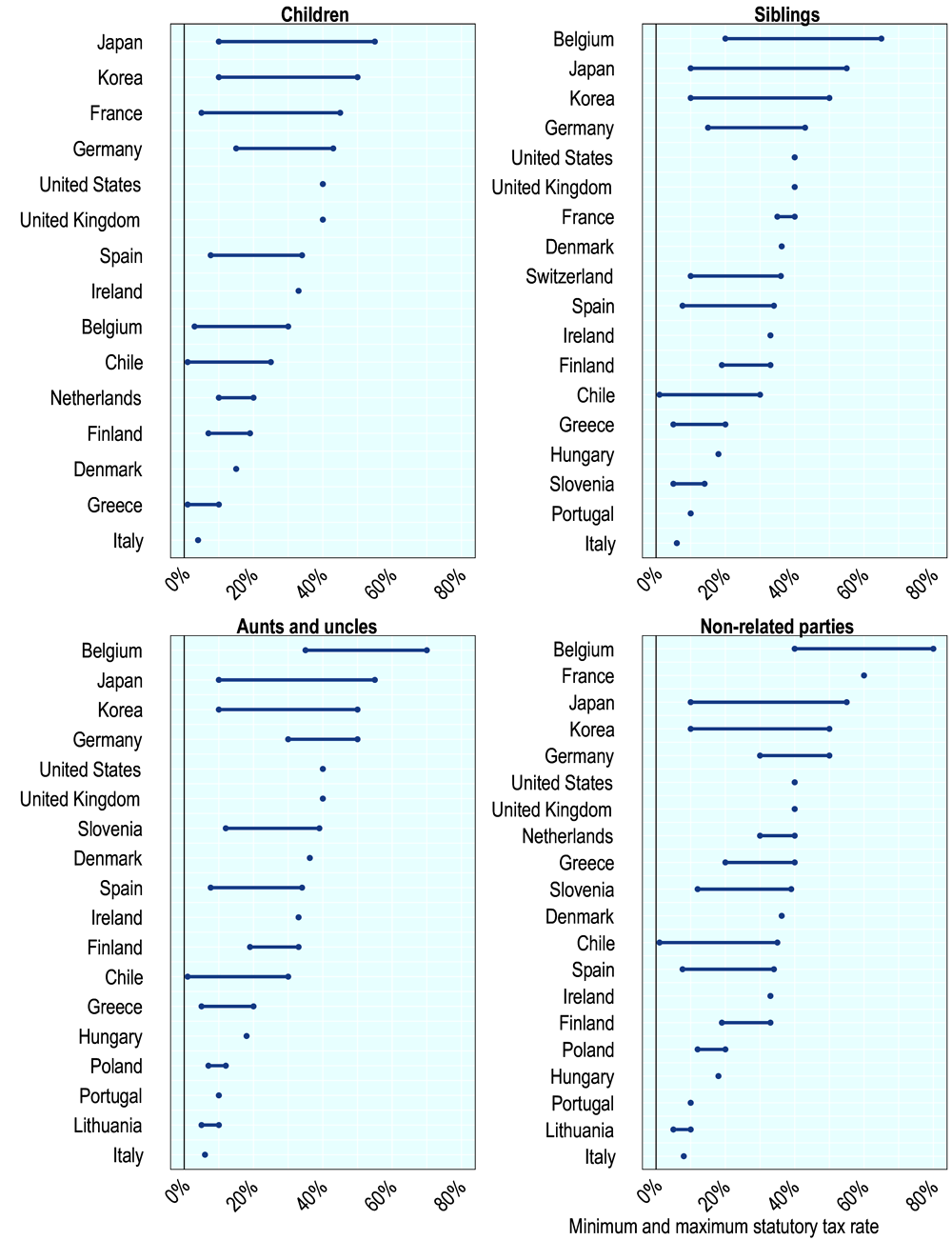

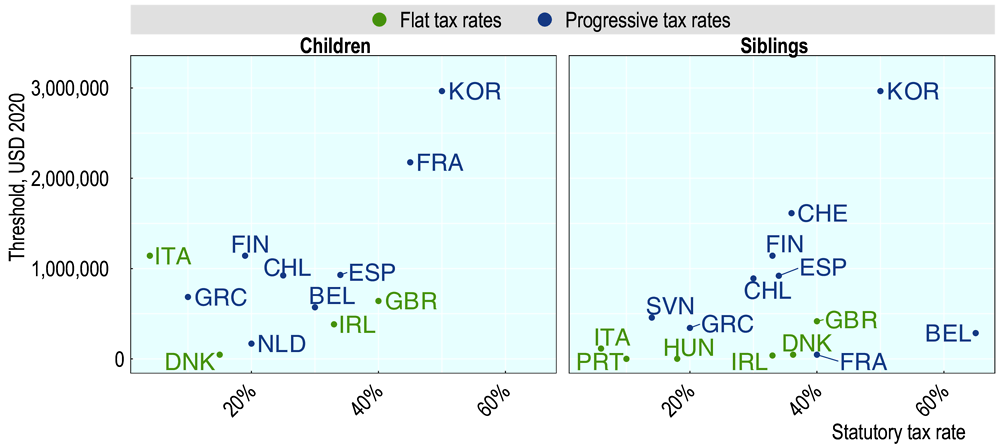

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Inheritance Taxation In Oecd Countries En Oecd

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Oecd Better Policies For Better Lives On Twitter The Distribution Of Wealth Is Highly Unequal Across Households On Average Across Oecd Countries 5 2 Of The Total Wealth Is Held By

Investors Must Beware Of High Korean Inheritance Tax Asia Times

Cover Story Will We See New Taxes On Inheritance And Capital Gains The Edge Markets

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Understanding Inheritance And Estate Tax In Asean Asean Business News

World Bank Says Malaysia Has Plenty Of Scope To Tax Capital Gains Or Inheritance Even As Politicians Say The Contrary Malay Mail

Question Of Inheritance Tax Resurfaces In Malaysia The Edge Markets

Common Questions On Property Inheritance In Malaysia

New Taxes That May Be Introduced In Malaysia Mypf My

Budget 2020 It S Time For Wealth And Inheritance Tax

Common Questions On Property Inheritance In Malaysia

0 Response to "inheritance tax malaysia"

Post a Comment